While the City were digesting Germany's sale, Portugal slipped out the results of its own debt auction. And the sale appears to have gone OK.

Unlike German, Portugal found buyers for the full ?1bn of three-month treasury bills on offer. It also managed to sell the debt at lower interest rate than at the previous auction, with yields dropping to 4.346% versus 4.873%.

There was also more demand for the bills, with the bid-to-cover ratio rising to 2.4 versus 2.0 (where 1.0 means the number of bids equalled the amount of debt on sale).

City analysts say that today's German bond auction is an improvement on November's sale of 10-year Bunds (when a third of debt was unsold), but nothing to cheer about.

Peter Chatwell of Credit Agricole said it was "much better than November's auction, but not particularly great either".

Michael Leister of DZ Bank agreed, saying:

It's not a good auction, but it's not a surprise. For a good auction we need a pronounced flight to quality environment which we didn't get in the past couple of days.

And Marc Ostwald of Monument Securities pointed out that the yield of just 1.93% means that people who bought the debt will see their returns comprehensively eroded by inflation:

For all that Germany it is a safe-haven, the fact of the matter is inflation is in the high 2s still and a yield of 1.93 (percent) over 10 years doesn't get you anything in real terms.

Germany's debt auction has also just concluded --- and the breaking news is that it has sold just over ?4bn of the ?5bn of 10-year Bunds on offer.

The Bundesbank reported that it sold ?4.057 of 10-year Bunds. The yield (or interest rate) on the debt fell slightly to 1.93%, from 1.98%, but this is the second auction in a row where the German Finance Agency has been forced to retain some debt.

We'd flagged up at 9.58am that there was a risk that the auction might not be fully subscribed (David Schnautz of Commersbank called the results very accurately).

The result certainly isn't a disaster, and it would be wrong to suggest that 'the markets' suddenly don't trust German debt. Looking at the table of results -- Germany actually received more than ?5bn of bids, but presumably some of the bids were unacceptably low.

Here come the auction results -- with the British debt sale going smoothly.

The UK Debt Management Agency just reported that it sold its ?3.75bn of five-year gilts at an average yield, or interest rate, of 1.106%. That's a drop from 1.143% at the last auction of this kind.

Will add reaction as it comes in.

One to bookmark -- my colleague Heather Stewart has compiled a very handy list of the main upcoming events in the Eurozone crisis this month:

Eurozone crisis: calendar of key events in January

It's going to be a hectic time -- with regular meetings of political leaders punctuated by almost daily auctions of government debt. And as a climax -- January will end with the IMF/EU/ECB troika delivering its report on Greece.

Eurozone inflation has fallen, bringing some relief to the region's consumers. Eurostat reported that the consumer prices index dropped to 2.8% in December, down from 3% in November.

I think that's all the economic data for the morning. Next up, those bond auction results....

Today's auction of 10-year German debt is particularly interesting as the previous sale of this type of debt, last November, flopped -- with a third of the bunds not sold.

David Schnautz of Commersbank has predicted that the auction will go "reasonably well", but that around 20% of the ?5bn of debt on offer might not find buyers.

An anonymous trader has also told Reuters that the sale could be "tricky". That's partly because German debt is now so highly valued that it offers a very low interest rate (the yield on 10-year bunds is trading around 1.93% this morning). Simply put, there are better (but riskier?) returns elsewhere.....

While the eurozone heads towards recession, the latest indication is that the UK economy probably stagnated in the last quarter of 2011.

That's the suggestion from this morning's survey of Britain's construction industry in December, which showed that growth in the sector picked up pace last month (rising to 53.2 from 52.3 on Markit's index).

Markit (who have had a busy morning) said the data means the UK construction sector probably grew in the last quarter, which should prevent Britain "sliding back into contraction".

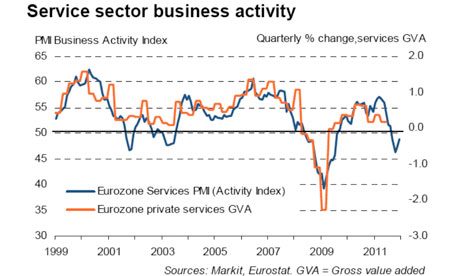

Service sector business activity. Source: Markit/Eurostat

Service sector business activity. Source: Markit/Eurostat The powerhouse German economy continues to outpace weaker rivals, according to new economic data that also suggests the eurozone is heading into recession.

Markit has reported that Germany's service sector picked up pace in December, with activity (as measured by its PMI survey) rising to 52.4 from 50.3 in November [so well above the 50-point mark that seperates expansion from contraction).

That, Markit said, means Germany's private sector returned to growth last month.

There was also good news for France, whose services sector expanded slightly in December with a PMI of 50.3.

The picture in other European countries was darker, though, with the eurozone's overall services sector shrinking again for the fourth month running (with a PMI of 48.8). Italy and Spain both saw their services sectors shrink sharply -- to 44.5 and 42.1 respectively.

As Chris Williamson, chief economist at Markit, put it:

Economic weakness is most evident in Italy and Spain, where domestic demand has been particularly hard hit by deficit-fighting austerity measures and growing uncertainty about the outlook. Recession is already looking inevitable in Italy, and is a growing possibility in Spain as well.

Other economists agreed that the data reinforces fears that the eurozone economy shrank in the last quarter of 2011.

Howard Archer, chief UK + European economist at IHS Global Insight, said:

While the December Eurozone services purchasing managers' survey showed improvement for a second month running, it still indicated a fourth successive month of contracting activity and the likelihood is that Eurozone GDP declined significantly in the fourth quarter of 2011.

Trouble in Italy, where shares in Unicredit -- the largest Italian bank by assets - have just been suspended after tumbling 10% since trading began at 8am.

The trigger is the news this morning that Unicredit's emergency ?7.5bn cash call is going to be priced at an even deeper discount than feared. The bank, which needs the funds to shore up its capital reserves, is selling shares at a 43% discount to their market value.

Details of the rights issue spooked investors, who had been braced for a 43% discount at the worst.

This Reuters story (written before the pricing was announced) has a good background explanation of the situation at Unicredit.

A very subdued start to trading in London, with the FTSE 100 up just 14 points at 5711. Most European markets are showing small losses.

Lord Wolfson's warning that Next's pre-Christmas sales suffered from the euro crisis reminds us that he is offering a ?250,000 prize to the economist who can devise the best way for a country to make an "orderly exit" for the euro.

The Conservative peer set the task in October, through his sponsorship of the Wolfson Economics Prize. He argued that:

There is now a real possibility that political or economic pressure may force one or more states to leave the euro. If this process is mismanaged it could threaten European savings, employment and the stability of the international banking system.

This prize aims to ensure that high quality economic thought is given to how the euro might be restructured into more stable currencies.

If you've got a great idea, it's not too late to submit it as the deadline is January 31st. More details here.

Lord Wolfson of Aspley Guise, chief executive of Next. Photograph: WPA Pool/Getty Images

Lord Wolfson of Aspley Guise, chief executive of Next. Photograph: WPA Pool/Getty Images Lord Wolfson of Aspley Guise,, the chief executive of retailer Next, has blamed Europe's financial crisis after reporting 'disappointing' high street sales in the run-up to Christmas.

In the last few minutes, Simon Wolfson said the Eurozone debt crisis was "impacting UK consumer behaviour". He was speaking after Next reported a 2.7% decline in high street sales between 1 August and 24 December, compared with last year.

In a trading statement released to the City at 7am, Next also warned shareholders that trading in 2012 would suffer from:

Continuing difficulties in the Eurozone and its adverse effects on business confidence and the UK banking sector.

Next is the first major UK retailer to report results since Christmas, and is seen as a decent bellwether of the sector. If it's feeling the chill from Europe, weaker rivals must also be shivering.

I wonder, though, whether UK shoppers are really being affected by the twists and turns in the euro crisis, or whether Britain's own economic problems are the main factor. If you're facing a pay freeze or struggling to keep pace with UK inflation, then the fate of the euro may slide down your list of priorities...What do you think?...

Here's an agenda of today's main events:

? Eurozone Services PMI - 8.58am GMT (9.58am CET)

? UK construction PMI - 9.30am GMT (10.30am CET)

? Eurozone inflation for December - 10am GMT (11am CET)

? UK auction of ?3.75bn five-year gilts - from 10am

? German auction of ?5bn of 10-year bunds - from 10.30am

? Portuguese auction of ?0.75bn-?1bn of three-month bills - from 10am

Good morning, and welcome to another day of rolling coverage of the Eurozone debt crisis.

It's going to be quite a lively morning, with Germany, Portugal and the UK all holding debt auctions. While Lisbon is aiming to shift short-term bills repayable in just three months, London and Berlin are both selling long-term bonds (five-year gilts and 10-year bunds). That should be a test of investor appetite as 2012 gets into full swing.

There is also plenty of economic data to tickle the appetite, including eurozone inflation for December, and a healthcheck on Britain's construction sector.

Elsewhere, Greece's warning yesterday that it might quit the euro in three months has ratcheted up the tension -- we'll be watching for further developments in Athens.

Source: http://www.guardian.co.uk/business/2012/jan/04/eurozone-crisis-debt-auctions

freedom writers lemony snicket lemony snicket jim thome jim thome fun fun fun fest fun fun fun fest

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.